More construction projects are starting up, but payments to contractors and their subcontractors continue to be a bottleneck in the normal course of a project.

“Banks are becoming more and more careful with their own financing of development projects, which means that they are also delaying payments on their own side.” Contrator CEO Anwar Ghauche told businessupdates.org. “What this means is that payment terms for subcontractors are getting longer, not shorter, and it’s only getting harder for subcontractors because they usually can’t turn to their banks to extend their lines of credit.”

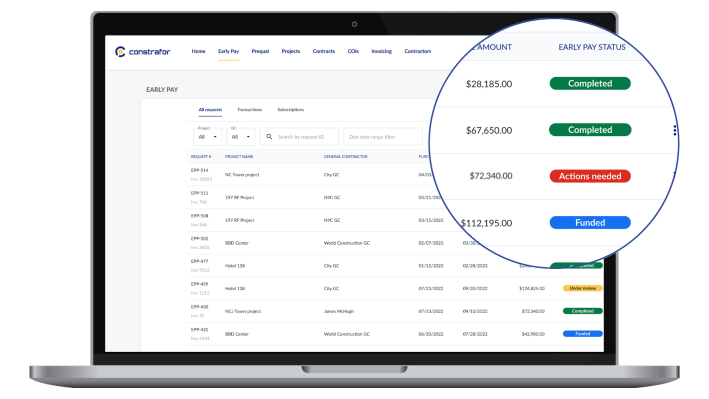

Ghauche and Douglas Reed started Constrafor, a construction SaaS procurement platform, to provide embedded financing and software for general contractors to manage their subcontractor workflow. The Early Pay program assumes the risk for the subcontractor invoice, freeing up cash flow and reliance on traditional and expensive borrowing options. The main contractor then reimburses the invoice to Constrafor.

The company raised $106.3 million in equity and debt in 2022 and since then Constrafor has grown from 15,000 customers to 23,000. Ghauche admits that the company “had a decline in sales” during this period, but that it had nothing to do with the credit market or the network. Since then, the company has adjusted its lending and is now growing 25% month over month “in sustainable growth” this year.

Constrafor also joined the AI trend by launching a number of initiatives using embedded generative AI related to automating manual reviews, for example of insurance. It also partnered with Stripe to offer a banking product and now has more than 80 companies banking with them.

Now, Constrafor is back with another $7.5 million cash infusion through a SAFE ticket, led by Motive Partners, which closed this month. New investor Fifth Wall joined existing investors including FinTech Collective, Clocktower Technology Ventures, Commerce Ventures, FJ Labs and NotreVis. This gives the company $14 million in equity and $100 million in debt since the company was founded in 2019.

Anwar Ghauche, CEO of Constrafor. Image Credits: Contrator

When asked why Constrafor went after a SAFE note instead of a priced round, Ghauche said he didn’t think the market was “great today in terms of pricing”.

“We have seen that deterioration in multiples for fintech companies,” added Ghauche. “We found that this is a much better way for us to continue to grow, hence our milestones on the revenue side for the Series A, so we are aiming to cross the $5 million ARR before we actually go for a Series A. Being $10 million ARR, that will be better.

In addition, the investment includes access to a credit facility with Apollo. That potential for additional capital gives Constrafor “scalable credit and capital for our company,” Ghauche said.

And at a time when other financial players are raising rates due to the difficult economic climate, Constrafor is able to lower its price for customers and pass the savings on to them, he added.

Meanwhile, the new capital will be used for payroll and operations financing. Ghauche plans to review its EarlyPay program and open up Constrafor’s APIs to general contractor customers.

“We’re seeing quite a few construction startups coming up right now, and we feel like we have a pretty big network right now, so we want to open up our platform for these companies to connect with ours and build on top of Constrafor,” said Ghauche.